Easterly Government Properties Inc Stock DEA Share Price Today, News and Discussion

Contents:

This is a higher news sentiment than the 0.49 average news sentiment score of Finance companies. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes. RBC Capital analyst Michael Carroll maintained a Hold rating on Easterly Government Properties (DEA – Research Report) on December 21 and set a price target of $15.00. EastGroup Properties witnessed a jump in share price last session on above-average trading volume.

What is DEA target price?

Easterly Government Properties Inc (NYSE:DEA)

The 6 analysts offering 12-month price forecasts for Easterly Government Properties Inc have a median target of 15.25, with a high estimate of 17.00 and a low estimate of 14.00. The median estimate represents a +9.24% increase from the last price of 13.96.

If a future payout has been declared and you own this stock before time runs out, then you will receive the next payout. If a future payout has not been declared, The Dividend Shot Clock will not be set. Helpful articles on different dividend investing options and how to best save, invest, and spend your hard-earned money. You must be a shareholder on or before the next ex-dividend date to receive the upcoming dividend.

Easterly Government Properties Inc DEA:NYSE

There may be delays, omissions, or inaccuracies in the Information. The technique has proven to be very useful for finding positive surprises. The company is scheduled to release its next quarterly earnings announcement on Tuesday, May 2nd 2023. Easterly Government Properties is a leading dividend payer. It pays a dividend yield of 7.59%, putting its dividend yield in the top 25% of dividend-paying stocks.

Updated daily, it takes into account day-to-day movements in market value compared to a company’s liability structure. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. These are established companies that reliably pay dividends.

MedMen completes Florida cannabis exit for $16 million less than … – Marijuana Business Daily

MedMen completes Florida cannabis exit for $16 million less than ….

Posted: Wed, 24 Aug 2022 07:00:00 GMT [source]

Reproduction of such information in any form is prohibited. © 2020 Market data provided is at least 15-minutes delayed and hosted by Barchart Solutions. Learn from industry thought leaders and expert market participants.

How big is Easterly Government Properties Inc?

According to 14 analysts, the average rating for DEA stock is “Sell.” The 12-month stock price forecast is $15.73, which is an increase of 19.71% from the latest price. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating.

Is easterly government properties a good stock?

The companies in the bottom 20% of the stock universe receive Growth Grades of F, considered Very Weak, while those in the top 20% receive A grades, which are considered Very Strong. Easterly Government Properties Inc has a Growth Score of 94, which is Very Strong.

This trading strategy invovles purchasing a stock just before the ex-dividend date in order to collect the dividend and then selling after the stock price has recovered. Schedule https://day-trading.info/ monthly income from dividend stocks with a monthly payment frequency. The latest trend in FFO estimate revisions for the stock suggests that there could be more strength…

Financial Calendars

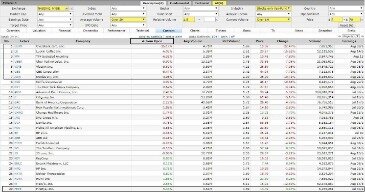

Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Shares Sold ShortThe total number of shares of a security that have been sold short and not yet repurchased.Change from LastPercentage change in short interest from the previous report to the most recent report. Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. Easterly Government Properties Inc’ stock price today is $13.16.

The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies. Income investors are always on the hunt for higher-dividend yields, but too often stocks with high-dividend yields can be yield traps that are at risk of being cut. According to analysts’ consensus price target of $17.25, Easterly Government Properties has a forecasted upside of 32.5% from its current price of $13.02. Easterly Government Properties reported an EPS of $0.18 in its last earnings report, beating expectations of $0.055. Following the earnings report the stock price went up 0.474%.

Market Cap is calculated by multiplying the number of shares outstanding by the stock’s price. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price. Easterly Government Properties, Inc. is an internally managed real estate investment trust . The Company focuses on the acquisition, development and management of Class A commercial properties that are leased to United States Government agencies. It leases its properties to such agencies either directly or through the United States General Services Administration.

Easterly Government Properties, Inc. is focused primarily on the acquisition, development and management of commercial properties leased to U.S. Moody’s Daily Credit Risk Score is a 1-10 score of a company’s credit risk, based on an analysis of the firm’s balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow.

Easterly Government Properties Schedules Fourth Quarter 2022 Earnings Release and Conference Call

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.52% per year.

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.DEA has a Quality Grade penny stocks trading guide for beginners of C, ranking ahead of 30.32% of graded US stocks. Of note is the ratio of EASTERLY GOVERNMENT PROPERTIES INC’s sales and general administrative expense to its total operating expenses; just 8.04% of US stocks have a lower such ratio.

To see all exchange delays and terms of use please see Barchart’s disclaimer. Raised $180 million in an IPO on Friday, February 6th 2015. The company issued 12,000,000 shares at $14.00-$16.00 per share. Citigroup, Raymond James and RBC Capital Markets served as the underwriters for the IPO and Piper Jaffray, PNC Capital Markets and SunTrust Robinson Humphrey were co-managers. Easterly Government Properties’ stock was trading at $14.27 on January 1st, 2023. Since then, DEA stock has decreased by 5.3% and is now trading at $13.51.

- Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

- Updated daily, it takes into account day-to-day movements in market value compared to a company’s liability structure.

- Customized to investor preferences for risk tolerance and income vs returns mix.

- According to 14 analysts, the average rating for DEA stock is “Sell.” The 12-month stock price forecast is $15.73, which is an increase of 19.71% from the latest price.

- Intraday data delayed at least 15 minutes or per exchange requirements.

- Intraday Data provided by FACTSET and subject to terms of use.

Easterly Government Properties released its earnings results on Feb 28, 2023. The company reported $0.18 earnings per share for the quarter, beating the consensus estimate of $0.055 by $0.125. Discover dividend stocks matching your investment objectives with our advanced screening tools. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities.

DEA’s current lowest rank is in the Sentiment metric (where it is better than 10.88% of US stocks). The Easterly Government Properties Inc 52-week low stock price is $13.41. The Easterly Government Properties Inc 52-week high stock price is $21.46. Build conviction from in-depth coverage of the best dividend stocks.

If you’re looking for stocks that are quantitatively similar to EASTERLY GOVERNMENT PROPERTIES INC, a group of peers worth examining would be BDN, AKR, HPP, REG, and EPR. The strongest trend for DEA is in Growth, which has been heading down over the past 177 days. Certain financial information included in Dividend.com is proprietary to Mergent, Inc. (“Mergent”) Copyright © 2014.

Digital Entertainment Asset Pte. Ltd., Names Tatsuya Kohrogi From … – GlobeNewswire

Digital Entertainment Asset Pte. Ltd., Names Tatsuya Kohrogi From ….

Posted: Tue, 31 May 2022 07:00:00 GMT [source]

A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated.

The number of shares of common stock to be sold and the price range for the proposed offering have not yet been determined. WASHINGTON, D.C., January 26, 2015 – Easterly Government Properties, Inc. announced today that it has commenced an initial public offering of 12 million shares of its common stock. The estimated price range of the common stock in the initial public offering is between $14.00 and $16.00 per share. The underwriters have the option to purchase up to an additional 1.8 million shares of common stock to cover over- allotments, if any. Learn more about dividend stocks, including information about important dividend dates, the advantages of dividend stocks, dividend yield, and much more in our financial education center. Real-time analyst ratings, insider transactions, earnings data, and more.

Is DEA a good dividend stock?

Current dividend yield vs market & industry

Notable Dividend: DEA's dividend (7.58%) is higher than the bottom 25% of dividend payers in the US market (1.63%).

These returns cover a period from January 1, 1988 through February 6, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return.

What does DEA mean in stocks?

Persons accessing trading venues via Direct Electronic Access (DEA) have the capacity to enter orders directly into a trading system in a way similar to a member or participant, i.e. with control over their trading decisions and reduced latency of execution.